Table Of Content

People flock to LA for the climate, luxurious homes, as well as the tech & movie industries. As such, Californians thinking of purchasing property should create a budget and begin saving for a down payment well in advance of deciding to buy a home. Equity refers to the difference between the amount you owe on your mortgage and how much your home is worth. If you owe $200,000 on your mortgage and your home is worth $300,000, then your equity is $100,000. The good news is that you can buy a house with less than 20% down though it is a good idea to put down as much as you can. Here are some of the considerations when thinking about how much of a down payment you may need for your dream house.

Bank accounts

Down payment assistance programs are usually limited to first-time homebuyers or low-income homebuyers; the definition of low-income will reflect local housing prices. Still, since the lender is investing more money in the property than you are, they’ll order an appraisal to get an independent, professional opinion on the property’s value. They’ll also check your credit score, income and debt to see if you’ll be able to pay the mortgage.

2 rules to consider when deciding how much mortgage you can afford, according to a financial planner - CNBC

2 rules to consider when deciding how much mortgage you can afford, according to a financial planner.

Posted: Thu, 25 Apr 2024 07:00:00 GMT [source]

What other costs should I anticipate when buying a house?

That’s why they often turn to loans with smaller minimum down payments. These loans, though, often require borrowers to purchase some form of mortgage insurance. Rather than simply borrowing the maximum loan amount a lender approves, evaluate your estimated monthly mortgage payment too. Lenders use two ratios to help determine the monthly mortgage amount you can afford. 28% of your gross monthly income is the maximum amount that should be used for housing expenses, including your monthly mortgage payment, homeowners insurance, and property taxes.

Business services

However, keep in mind that gift money is subject to lender regulations. For example, if you’re taking out an FHA loan, the gift must come from a close family member. This will include details like your loan amount, interest rate, monthly payment and closing costs. Whether a down payment is required depends on the type of mortgage you choose. You’ll have to put money down on a conventional loan or FHA loan, though you won’t need to with a USDA or VA loan.

Why Lenders Typically Require A Down Payment

Missouri First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Missouri First-Time Home Buyer 2024 Programs and Grants.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits. Connect with a Chase Private Client Banker at your nearest Chase branch to learn about eligibility requirements and all available benefits. These articles are for educational purposes only and provide general mortgage information. Products, services, processes and lending criteria described in these articles may differ from those available through JPMorgan Chase Bank N.A. The views expressed in this article do not reflect the official policy or position of (or endorsement by) JPMorgan Chase & Co. or its affiliates. Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual.

How does your credit score impact your down payment?

But it is a monthly cost in addition to your mortgage, and unlike your mortgage payments, PMI payments will not help you build equity in your home. With this type of mortgage, you keep the same interest rate for the life of the loan, which means the principal and interest portion of your monthly mortgage payment stays the same. These types of loans typically come in 10, 15, 20 or 30-year terms. If you want to sell your home and the market drops, you might owe more on your property than it's worth.

Places with the highest median down payments (in dollars)

A down payment is part of the homebuying process and a requirement for some of the most popular types of mortgages. A smaller down payment will get you into your home quicker and leave you more money to cover repairs and insurance and to invest in other financial goals. If you put down 10 percent or more, this annual MIP can be removed after 11 years.

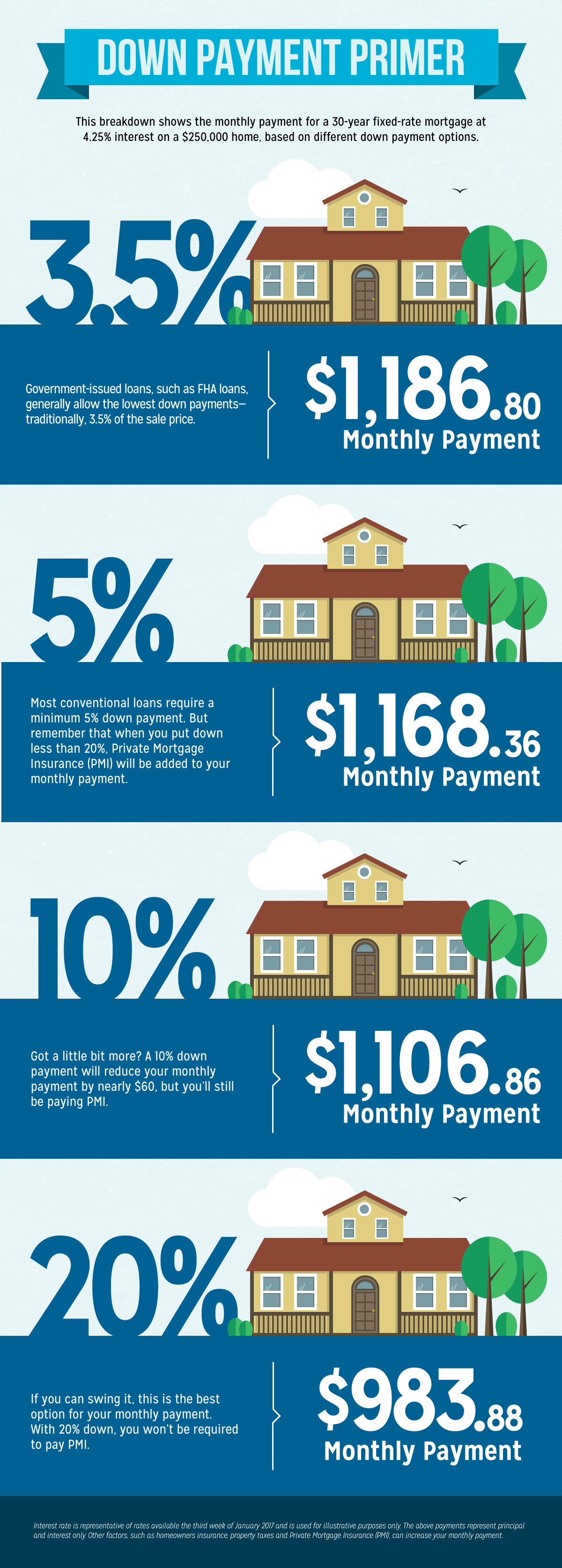

A down payment on a house is the initial cash payment the buyer makes during a real estate transaction. The down payment represents a percentage of the total purchase price of the home. If you’re required to make a down payment, you might put down between 3 percent and 20 percent of the home’s purchase price, depending on your savings and what type of mortgage you’re getting. How much you should put down on a house depends on the type of loan you’re applying for and your financial situation. Ideally, you’ll want to put down as much as you can comfortably afford to increase your approval odds, possibly avoid mortgage insurance and have a more affordable monthly mortgage payment.

For many first-time homebuyers, this means the idea of buying their own house is within reach sooner than they think. How much down payment you'll need for a house depends on the loan you get. While there are benefits to putting down the traditional 20% — or more — it may not be required. High-yield savings accounts (HYSAs) can earn more than 5% interest while still allowing you to make withdrawals if something unexpected happens. Western Alliance Bank's HYSA currently earns an APR of 5.32%, one of the highest CNBC Select has reviewed. You only need a dollar to open an account, and there's no minimum balance requirement or monthly fees.

While your lender may be comfortable with lending you money with a low percentage down payment, many condo buildings have maximum financing restrictions. Generally, condos require owners to purchase with a minimum down payment of 10%, or 90% max financing, but this can vary from building to building. For example, if you purchase a $1,500,000 home in La Jolla, expect to make a down payment of at least $225,000 to $300,000 on average. While some buyers want to put more money down to reduce monthly payments, many first-time homebuyers in California ask how they can reduce their initial down payment. Mortgages issued by lenders require an investment of capital from buyers to secure financing, and the type of loan dictates the required down payment.

VA loans are available to most members of the armed forces and veterans and their families. USDA loans, on the other hand, are available to borrowers planning to purchase homes in designated rural areas. Department of Agriculture (USDA) guarantee zero-down payment loans for qualified homebuyers. Keep in mind, too, that to avoid PMI, you’ll need to put down at least 20 percent. If you can’t afford that high of a down payment, though, know you won’t pay PMI forever. Once you reach 20 percent equity in your home, you can request that your lender remove PMI from your bill.

See how we're dedicated to helping protect you, your accounts and your loved ones from financial abuse. Also, learn about the common tricks scammers are using to help you stay one step ahead of them. If you see unauthorized charges or believe your account was compromised contact us right away to report fraud. This type of loan is only available for U.S. military veterans and active duty servicemembers.

And we’ve written a separate article on the subject, if you’d like to learn more about it. With a 5% down payment and an interest rate of 7.158% (the average at the time of writing), you will want to earn at least $8,742 per month – $104,904 per year – to buy a $400,000 house. With a 5% down payment and an interest rate of 7.158% (the average at the time of writing), you will want to earn at least $6,644 per month – $79,728 per year – to buy a $300,000 house.

Use our quick guide to understand what a down payment is, why you usually need to save for one and how much you should put down to buy a home. In general, the younger a buyer is, the more likely they are to make a smaller down payment. A second home is a residence you occupy in addition to your primary residence.

Knowing the down payment amount you’re comfortable with can help you search for homes in your budget and keep you from draining your savings. It’s important to note that down payment requirements aren’t solely determined by lenders. In many cases, the down payment requirement is set by the entity backing the loan, which may be the FHA, Fannie Mae or the Department of Veterans Affairs (VA). The amount you put toward a down payment can dictate the loan amount you qualify for and the terms of your mortgage repayment. Putting money down on a house also helps lower your total loan amount. The less money you borrow, the more money you save on interest over the life of the loan.

You’ll pay the second installment along with other closing costs on your closing day. There are also some private lenders that offer no-money-down mortgages, such as Navy Federal Credit Union and North American Savings Bank. The average down payment on a home is 12%, according to the National Association of Realtors.

No comments:

Post a Comment